Portfolio diversification is one of the most fundamental principles of investing. By spreading investments across different asset classes, sectors, and geographies, investors aim to reduce risk and enhance returns. Traditionally, diversification strategies have relied on historical performance data, market correlations, and economic forecasts. However, alternative data is now playing a critical role in helping investors take a more nuanced and dynamic approach to portfolio diversification.

Alternative data offers real-time insights into market trends, consumer behaviour, and global events, allowing investors to make better-informed decisions about how to allocate assets across their portfolios. In this blog, we’ll explore how alternative data is enhancing portfolio diversification and helping investors build more resilient investment strategies.

What Is Alternative Data for Portfolio Diversification?

Alternative data encompasses a wide range of non-traditional data sources that provide valuable insights into market conditions, company performance, and economic trends. For portfolio diversification, some of the most commonly used alternative data types include:

- Geolocation data: Tracking foot traffic, transportation patterns, and business activity in specific regions.

- Social media sentiment: Analysing consumer sentiment, public opinion, and brand reputation.

- Transaction data: Monitoring real-time consumer spending and purchase behaviour.

- Satellite imagery: Observing industrial activity, energy production, and agricultural yields.

- Web traffic data: Tracking online consumer engagement and sales trends for e-commerce companies.

By incorporating these data sources into their diversification strategies, investors can gain a more accurate understanding of where to allocate their capital to maximise returns while managing risk.

Why Alternative Data is Critical for Portfolio Diversification

Diversification strategies require a deep understanding of both risk and opportunity. While traditional data sources offer insights into market performance, they often rely on historical information or lagging indicators. Alternative data, on the other hand, provides real-time, actionable insights that allow investors to make more dynamic adjustments to their portfolios.

Here’s why alternative data is crucial for portfolio diversification:

1. Identifying Emerging Market Trends

Alternative data helps investors identify emerging trends and opportunities that may not be immediately visible through traditional financial data. Whether it’s tracking shifts in consumer behaviour, changes in regional economic activity, or technological advancements, alternative data provides early signals that can guide portfolio allocation decisions.

- Example: Investors tracking web traffic data for an emerging e-commerce company notice a sharp increase in online sales during a product launch. This early signal of strong consumer demand allows investors to diversify their portfolios by adding exposure to high-growth sectors like e-commerce.

2. Improving Sector-Specific Diversification

By analysing alternative data, investors can gain more granular insights into specific sectors and industries. For example, tracking satellite imagery of industrial production can provide early indicators of growth or contraction in sectors like manufacturing, agriculture, or energy. This data helps investors diversify across sectors that are poised for growth while reducing exposure to sectors facing headwinds.

- Example: Satellite imagery shows increased activity at a major oil field, suggesting a potential uptick in energy production. Investors use this data to diversify their portfolios by increasing their exposure to energy stocks, positioning themselves for potential growth in the sector.

3. Enhancing Geographic Diversification

Geolocation data provides valuable insights into regional economic activity, helping investors assess how different geographic areas are performing. This data allows investors to diversify across regions, reducing risk by spreading investments across multiple geographies.

- Example: Geolocation data reveals that foot traffic and economic activity are increasing in Southeast Asia, signalling growth in the region. Investors use this data to diversify geographically, adding exposure to emerging markets in Southeast Asia to their portfolios.

4. Managing Risk Through Real-Time Insights

One of the primary goals of diversification is to manage risk. Alternative data helps investors identify risks in real time, allowing them to adjust their portfolios quickly in response to changing market conditions. Whether it’s tracking social media sentiment to gauge consumer confidence or using transaction data to monitor spending patterns, alternative data provides early warning signs of potential risks.

- Example: Social media sentiment around a leading tech company starts to turn negative after a product recall. Investors tracking this data reduce their exposure to the company’s stock, mitigating the risk of a potential price decline before the broader market reacts.

How Investors Use Alternative Data to Enhance Diversification

Here’s how alternative data is being used by investors to enhance their portfolio diversification strategies:

1. Tracking Global Economic Activity with Geolocation Data

Geolocation data allows investors to track global economic activity by monitoring transportation routes, foot traffic, and infrastructure development. This data helps investors identify regions or countries that are experiencing growth, allowing them to diversify geographically and capitalise on new opportunities.

- Example: Investors tracking geolocation data in Europe notice increased transportation activity and economic growth in Eastern European countries. This data prompts them to diversify their portfolios by adding exposure to emerging markets in the region.

2. Analysing Consumer Behavior with Transaction Data

Transaction data offers real-time insights into consumer behaviour, helping investors assess spending patterns and identify growth opportunities across sectors like retail, hospitality, and e-commerce. This data allows investors to diversify their portfolios based on actual consumer demand, rather than relying solely on historical data.

- Example: Investors tracking credit card transaction data during the holiday shopping season notice a surge in spending on online retail platforms. This data prompts them to diversify their portfolios by increasing their exposure to e-commerce stocks, which are benefiting from strong consumer demand.

3. Monitoring Sector Growth with Satellite Imagery

Satellite imagery provides valuable insights into sector-specific trends, such as energy production, industrial output, and agricultural yields. By tracking these data points, investors can identify which sectors are expanding and adjust their portfolios accordingly.

- Example: Investors tracking satellite imagery of wind farms notice an expansion in renewable energy capacity. This data prompts them to diversify their portfolios by increasing their exposure to clean energy stocks, positioning themselves to benefit from growth in the renewable energy sector.

4. Gauging Market Sentiment with Social Media Analysis

Social media sentiment analysis provides real-time insights into how the public feels about specific companies, products, or industries. By tracking sentiment around key market players or sectors, investors can gauge market sentiment and adjust their diversification strategies to manage risk and capitalise on positive momentum.

- Example: Investors tracking social media sentiment around electric vehicle (EV) companies notice an increase in positive discussions about EV technology and adoption rates. This data prompts them to diversify their portfolios by adding exposure to the EV sector.

Real-World Examples of Alternative Data Enhancing Diversification

Example 1: Diversifying in the Retail Sector Using Web Traffic Data

Investors tracking web traffic data for major retailers noticed that one online retailer was experiencing a surge in site visits and conversions during the holiday shopping season. This data allowed investors to diversify their portfolios by increasing their exposure to e-commerce stocks, while reducing exposure to traditional brick-and-mortar retailers.

Example 2: Enhancing Geographic Diversification with Geolocation Data

A real estate investor used geolocation data to track economic activity in several emerging markets. By analysing transportation routes, foot traffic, and infrastructure development, the investor identified a growing city in Southeast Asia as a prime location for commercial real estate investment. This geographic diversification strategy helped the investor capitalise on growth in the region.

Example 3: Managing Risk in the Energy Sector with Satellite Imagery

During a period of geopolitical tension, investors tracking satellite imagery of key oil fields noticed a reduction in activity, signalling potential supply disruptions. By adjusting their portfolios to reduce exposure to the energy sector, investors were able to manage risk more effectively while diversifying into less volatile sectors.

Challenges of Using Alternative Data for Diversification

While alternative data offers valuable insights for portfolio diversification, there are challenges to consider:

1. Data Interpretation and Analysis

Alternative data often requires specialised tools and expertise to analyse effectively. Investors must ensure that they have the resources to interpret large datasets and extract meaningful insights to guide diversification strategies.

2. Cost of Data Access

Accessing high-quality alternative data can be expensive, particularly for retail investors or smaller firms. Investors must weigh the costs of acquiring alternative data against the potential benefits of enhanced portfolio diversification.

3. Data Privacy and Compliance

Investors must ensure that the alternative data they use complies with data privacy regulations, such as GDPR or CCPA, and is collected ethically. Failure to adhere to these regulations can pose legal and reputational risks.

The Future of Alternative Data in Portfolio Diversification

As technology advances and alternative data becomes more accessible, its role in portfolio diversification will continue to grow. With AI and machine learning tools improving the ability to analyse vast datasets, investors will be able to make more precise, data-driven decisions about how to diversify their portfolios.

Alternative data is transforming the way investors approach portfolio diversification by providing real-time, actionable insights into market trends, sector performance, and geographic opportunities. By leveraging data such as geolocation, social media sentiment, and satellite imagery, investors can make more informed decisions about how to allocate their assets and manage risk.

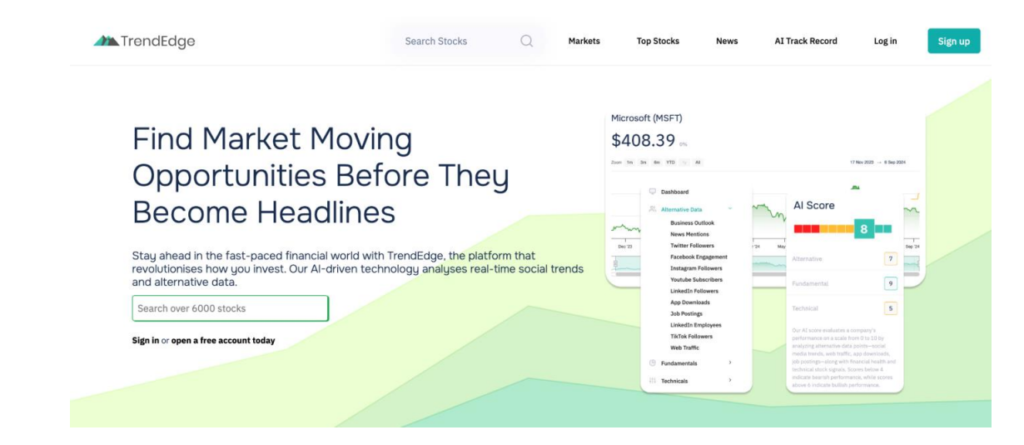

For investors looking to enhance their portfolio diversification with alternative data, explore the tools available on TrendEdge. With access to cutting-edge data analytics, you can build a more resilient and diversified investment strategy in today’s dynamic markets.