Custom clearance refers to the process of meeting government regulations when shipping goods across international borders. It involves various steps, including submitting necessary documentation, paying applicable duties and taxes, and complying with local laws.

Key documents required for custom clearance include:

- Commercial Invoice: Details the transaction between the seller and buyer.

- Packing List: Lists the contents of the shipment, detailing quantities and descriptions.

- Bill of Lading: Serves as a receipt for the shipment and outlines the contract between the shipper and carrier.

- Customs Declaration: Provides information on the type and value of goods being imported or exported.

Custom clearance is a crucial process in international trade that ensures goods move smoothly across borders. It involves the submission of necessary documents and payment of duties to comply with local laws. Understanding custom clearance is essential for businesses and individuals alike, as it can significantly impact shipping times and costs

Failure to comply with customs regulations can result in delays, fines, or confiscation of goods. Timely and accurate submission of documents streamlines the clearance process, ensuring efficient movement of shipments.

Custom clearance processes vary by country, impacting shipping times and costs. Understanding each country’s specific requirements can significantly improve the effectiveness of logistics operations.

Importance Of Custom Clearance

Custom clearance plays a vital role in international trade, streamlining the movement of goods across borders. Understanding its significance enhances logistics efficiency for businesses and individuals alike.

Regulatory Compliance

Regulatory compliance ensures adherence to government laws and regulations during the import and export processes. Compliance prevents legal issues, helping avoid penalties. Each country mandates specific documentation and duties, so knowing and following these rules is essential. Properly completed documents, such as the Commercial Invoice and Customs Declaration, ensure that goods clear customs without unnecessary delays.

Trade Facilitation

Trade facilitation speeds up cross-border transactions, benefiting the global economy. Efficient custom clearance reduces shipping times and costs, fostering smoother trade relations. Quick clearance processes encourage businesses to expand their markets, creating opportunities for growth. By complying with customs regulations, companies improve their competitiveness and establish trust with partners, leading to lasting commercial relationships.

The Process Of Custom Clearance

Custom clearance involves several steps and documentation to ensure compliance with government regulations when shipping goods internationally.

Documentation Requirements

Accurate documentation is crucial for successful custom clearance. Key documents include:

- Commercial Invoice: This document provides a detailed account of the goods, including description, quantity, and value.

- Packing List: This list outlines the contents, providing details on how the goods are packed and identifying the items in each shipment.

- Bill of Lading: This official document serves as a receipt for the shipment and provides proof of the contract between the shipper and the carrier.

- Customs Declaration: This form provides information about the goods being imported or exported, required by customs authorities to assess duties and taxes.

Each country may require additional specific documentation based on local regulations.

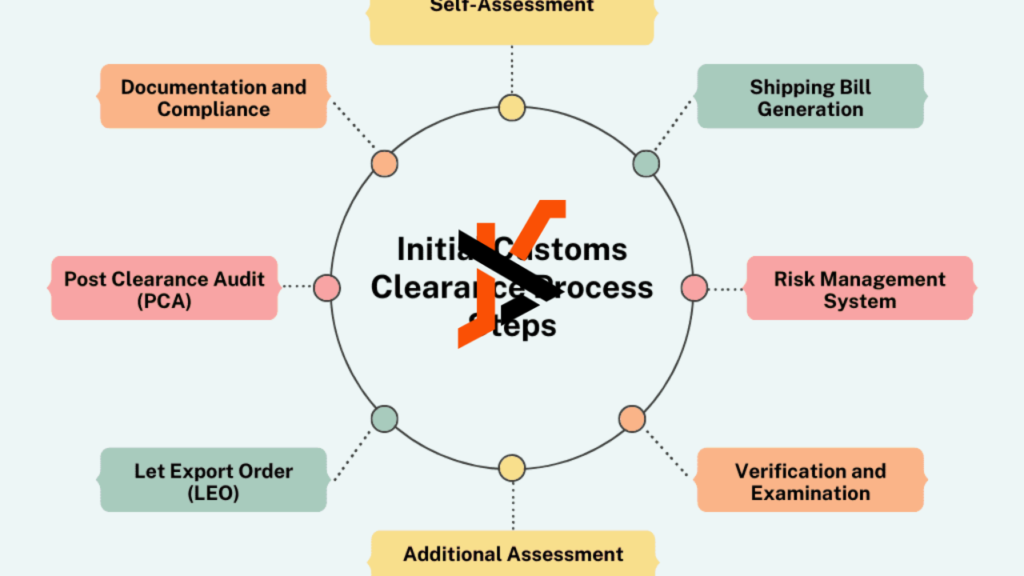

Steps In The Customs Clearance Process

The customs clearance process involves several distinct steps:

- Submission of Documents: Submit all required documents to the customs authority promptly to facilitate review.

- Assessment of Duties and Taxes: Customs assesses the value of goods to determine applicable duties and taxes that must be paid.

- Customs Inspection: Authorities may inspect shipments to verify content and compliance with laws. This step is not always required but can lead to delays if deemed necessary.

- Payment of Duties and Taxes: Pay assessed duties and taxes to ensure the clearance process continues smoothly.

- Release of Goods: After payment and approval, customs releases the goods for delivery, allowing the shipment to proceed to its final destination.

Adhering to these steps ensures efficient movement of shipments through customs, reducing potential delays and additional costs.

Challenges In Custom Clearance

Custom clearance presents specific challenges impacting the efficiency of international shipping. Understanding these challenges allows for better preparation and smoother operations.

Common Issues Faced

- Documentation Errors: Incomplete or inaccurate documents often delay clearance. Missing forms like the Commercial Invoice or Packing List can lead to significant shipping disruptions.

- Regulatory Compliance: Different countries enforce unique regulations. Failure to comply with specific customs laws can result in penalties or confiscation. It’s crucial to stay informed about these rules.

- Duties and Taxes Confusion: Miscalculating applicable duties and taxes can complicate the clearance process. Incorrect assessments may lead to unexpected expenses and delays.

- Customs Inspections: Random inspections can occur, resulting in extended shipping times. These inspections might check for compliance with regulations or potential security risks.

- Language Barriers: Communication issues may arise due to differing languages, making it harder to clarify requirements or resolve disputes.

- Thorough Documentation: Ensure all necessary documents are complete and accurate. Double-check forms for correctness before submission.

- Stay Updated: Regularly review relevant regulations for each country involved in shipping. This awareness helps avoid compliance issues.

- Budget for Duties: Calculate and budget for applicable duties and taxes in advance. Consulting with customs brokers can provide clarity on these costs.

- Choose Reliable Partners: Work with experienced customs brokers or freight forwarders. Their expertise can help navigate complex clearance processes effectively.

- Improve Communication: Use clear and concise language when communicating with customs officials. Providing translations when necessary can help reduce misunderstandings.

Conclusion

Custom clearance is a critical component of international trade that ensures goods move efficiently across borders. By understanding the necessary documentation and compliance requirements, businesses and individuals can avoid costly delays and penalties.

Managing the complexities of customs regulations is essential for successful shipping operations. With the right knowledge and preparation, stakeholders can improve their logistics strategies and foster stronger relationships in the global marketplace. Emphasizing accurate documentation and staying informed about specific country requirements can lead to smoother customs experiences and improved trade outcomes.