In the fast-evolving world of mergers and acquisitions (M&A), the technological foundations of a company have become a decisive factor in determining its value and future potential. Today, tech-driven due diligence is no longer optional; it’s essential. Investors and acquiring companies must understand the intricacies of a target’s technology stack to identify risks, uncover opportunities, and ultimately understand how tech can drive extra value for the company.

What is Technology Due Diligence?

Tech due diligence is a comprehensive assessment of a company’s technological assets, including its software, IT systems, intellectual property (IP), and overall digital infrastructure. The goal is to evaluate the strength, scalability, and security of these assets while identifying any hidden vulnerabilities that could impact the business’s operations or value.

This process typically includes an in-depth analysis of the following elements:

Code quality

Evaluating software code involves checking its efficiency, readability, and maintainability. High-quality code is not only easier to update and scale but also reduces the likelihood of bugs or system failures and prevents future technical debt A thorough review of the source code can be done using scanners and will identify areas for improvement and ensures alignment with industry best practices.

Intellectual Property

This step involves verifying the ownership of key technological assets, such as patents, trademarks, and copyrights, while also ensuring there are no disputes or legal encumbrances. But most of all, what is fundamental is to determine if the target company uses any third-party or open-source components and whether these are properly licensed. Failure to comply with open source licencing terms can result in legal disputes and costly fines.

Cybersecurity

Cybersecurity assessments focus on identifying vulnerabilities in IT systems, networks, and software. This includes evaluating defenses against potential threats such as hacking, ransomware, and data breaches. A strong cybersecurity posture not only protects the business but also fosters trust among stakeholders.

Scalability

Scalability examines whether the existing technology infrastructure can support projected growth without compromising on performance. The review includes analysing system architecture, server capacity, and software design to ensure they can handle increased user demand and integration with new technologies post-acquisition.

Regulatory compliance

Compliance reviews ensure that the company adheres to applicable laws, standards, and industry regulations, such as GDPR or ISO certifications. Failure to meet compliance standards can result in hefty fines and damage to reputation, making this an essential part of the due diligence process.

Why is it so important?

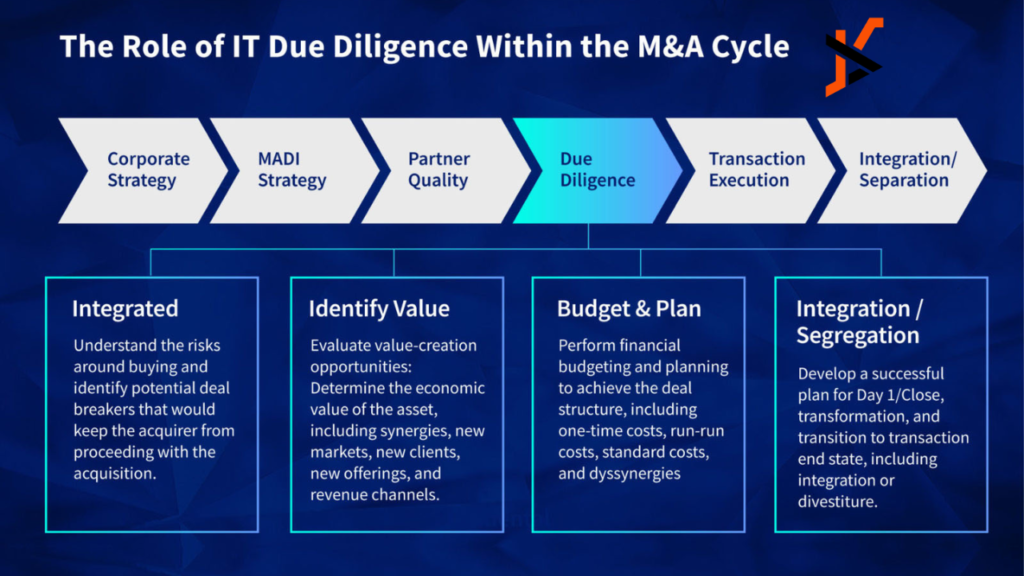

In M&A transactions, technology can be a deal-maker or breaker. Investors are increasingly interested in how a target’s technological capabilities align with their own goals and strategies. A sturdy tech due diligence process helps uncover key insights, such as:

Risk mitigation, to identify vulnerabilities in the target’s IT systems, such as outdated software, security gaps, or unlicensed third-party components.

Valuation accuracy, to provide a clearer picture of the company’s value by factoring in the quality and scalability of its tech stack.

Strategic alignment, to determine whether the target’s technology and tech skills align with the acquirer’s long-term objectives.

Post-acquisition planning and ongoing monitoring, to highlight potential integration challenges and offering solutions to address them proactively throughout the lifecycle of the portfolio company.

Common risks uncovered

Failing to conduct thorough technology due diligence can result in unwelcome surprises post-acquisition, which include:

Hidden liabilities

This often arises from the undisclosed use of third-party code or unlicensed software within a company’s technology stack. Such issues can lead to costly legal disputes and operational disruptions if not addressed early.

Cybersecurity gaps

These weaknesses leave the company vulnerable to data breaches, ransomware attacks, and other cyber threats. Assessing the robustness of existing defenses and identifying potential vulnerabilities is essential to protect sensitive information and maintain stakeholder trust.

Scalability challenges

A lack of scalability in technology infrastructure can hinder a company’s ability to support future growth or integrate effectively with the acquirer’s systems. This includes limitations in software architecture, server capacity, or database performance.

Non-compliance

Regulatory non-compliance can lead to significant fines, operational restrictions, and reputational damage. It’s essential to evaluate adherence to relevant standards and laws, to ensure a smooth transition post-acquisition.

The role of Tech Due Diligence providers

Engaging an experienced tech due diligence provider is critical to conducting a thorough and unbiased analysis. These experts bring specialised tools and methodologies to evaluate every aspect of a target company’s technology.

An effective provider will deliver actionable insights on risks and opportunities, highlight areas requiring immediate attention, and recommend strategies to optimise technology post-acquisition.

Conclusion

Technology due diligence is more than just a box to check in the M&A process. It’s a strategic tool that enables investors to make smarter decisions, mitigate risks, and maximize the value of their investments. As technology continues to shape the business landscape, understanding a target’s digital assets is essential for any successful transaction.