Private wealth management is a tailored financial and investment advisory service designed for high-net-worth individuals or families who deserve specialised attention to manage their wealth. It encompasses a range of financial services and strategies aimed at optimising the client’s wealth, addressing their financial goals, and preparing for future needs. Consistent with the nature of this service, it demands a high level of sophistication and understanding of financial markets and instruments.

At the core of private wealth management is the relationship between the individual or family and their wealth manager. This partnership aims to create a comprehensive plan that covers all aspects of wealth, including investments, estate planning, tax advisory, and philanthropy among other services. The fundamental purpose is to maintain and grow wealth over time while minimising financial risks and exposure to volatility.

Understanding Your Financial Goals

Before delving into the complex realm of wealth management, it’s crucial for clients to have a clear understanding of their financial objectives. Financial goals can vary significantly from one individual to the next; they could range from maintaining wealth to ensuring its growth, or from planning for a future generation to contributing to philanthropic causes. Understanding what you want to achieve with your wealth will guide the strategies put in place by your wealth manager.

Asset Allocation and Diversification

Two of the most important strategies in private wealth management are asset allocation and diversification. Asset allocation refers to the distribution of investable assets across various asset classes like equities, fixed income, real estate, commodities, and more, based on the individual’s risk tolerance and investment horizon. Diversification involves spreading investments within these asset classes to mitigate risk. The objective is to balance risk and return optimally.

Choosing the Right Wealth Management Firm

It’s imperative to select a wealth management firm that aligns with your values and understands your specific financial situation. Trust, transparency, and a strong track record are qualities to look for. Wealth management firms should not only provide excellence in service and expertise but should also foster a mutual understanding and respect for the client’s life goals and financial aspirations.

Firms that specialise in private wealth management are well equipped to handle complex financial situations and offer holistic advice that encompasses the entirety of an individual’s or family’s wealth. While generic financial advice may cater to a broader audience, the personalised touch and custom advice that comes with private wealth management are invaluable.

Integrated Financial Planning

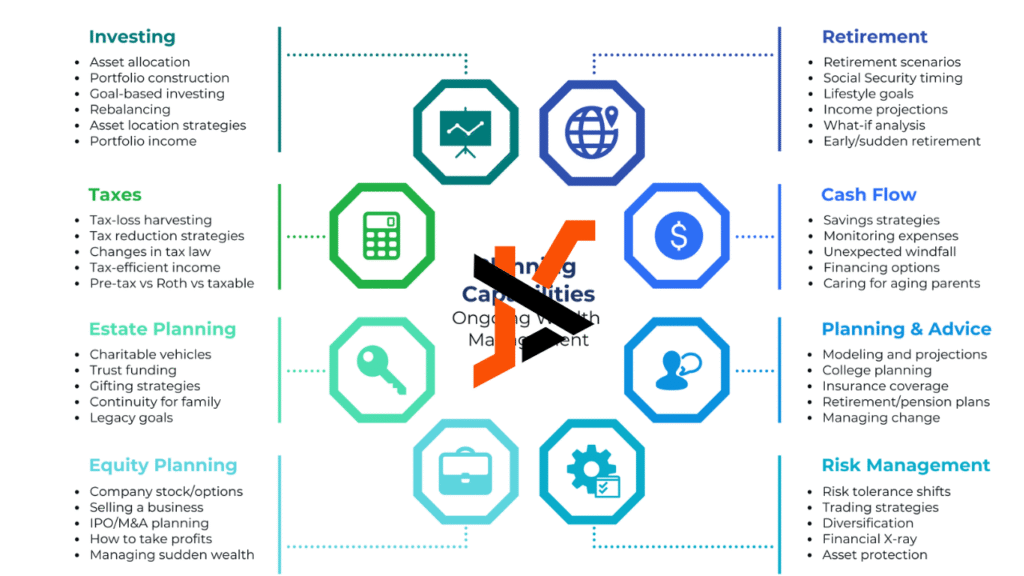

Effective wealth management considers not only asset management but also integrates financial planning to ensure a comprehensive approach to wealth. This generally includes retirement planning, risk management through appropriate insurance coverages, estate planning to secure wealth transfer, as well as charitable giving. All these facets should be aligned under a cohesive plan to optimise the client’s financial position.

The Importance of Tax Planning

Another critical element in wealth management is tax planning. It involves structuring the wealth in a way that minimises tax liabilities while remaining compliant with tax laws and regulations. An astute wealth manager will coordinate with tax professionals to ensure that the client’s investments and financial activities are as tax-efficient as possible without compromising on the growth objectives.

Estate and Succession Planning

For many high-net-worth individuals and families, ensuring that their wealth is transferred to future generations or chosen philanthropic endeavours is a significant concern. Estate planning involves setting up legal structures like trusts and wills to ensure that assets are distributed according to the client’s wishes. Succession planning also plays into the realm of private wealth management by guarding against any uncertainties that might disrupt the transfer of wealth.

Constant Monitoring and Evaluation

An essential service of wealth management is the ongoing monitoring and evaluation of investment strategies and financial plans. Markets and personal circumstances evolve, and as such, it’s critical that the wealth management strategy remains agile and responsive. Regular reviews ensure that the client’s portfolio and financial plan are performing in line with expectations and are adjusted accordingly for any changes in the financial landscape or personal situation.

Philanthropy and Social Responsibility

Wealth management is not solely about growing and protecting wealth; for many, it provides an opportunity to give back. Philanthropy can be an integral part of a wealth management strategy, allowing clients to support causes they are passionate about in a sustainable and impactful manner. This can also dovetail with tax planning strategies, as charitable giving can provide tax benefits under certain jurisdictions.

Education and Client Empowerment

A notable wealth management firm will place great emphasis on educating and empowering its clients. It is important for individuals and families to understand their financial situation and the strategies being deployed. Knowledgeable clients are better positioned to make informed decisions in tandem with their wealth manager and feel more confident in the plans laid out for them.

The Role of Technology in Wealth Management

The integration of technology into wealth management has revolutionised how firms provide services to clients. From advanced analytics in portfolio management to digital platforms for client communication and education, technology enhances the wealth management experience, making it more accessible and personalised.

Conclusion

Wealth management is a complex yet critical service for individuals and families with significant wealth. It should be approached with a clear understanding of financial goals, a well-thought-out strategy that includes diversification, tax planning, and estate planning, and should be delivered by a trustworthy firm specialising in private wealth management. Navigating the depths of wealth management requires a partnership with experts who can tailor a strategy unique to your situation and help secure your financial legacy for the future.