The world of trading is filled with various strategies, each claiming to provide traders with an edge in the financial markets. One such strategy that has garnered attention over the years is the Turtle Soup trading strategy. Originally developed in the 1980s by trading legend Richard Dennis, this strategy aims to capitalize on market reversals following significant price movements. In this article, we will delve into the turtle soup trading strategy success rate, analyze its success rate, discuss its mechanics, and explore the factors that can influence its effectiveness.

Turtle Soup Trading Strategy Success Rate

The Turtle Soup trading strategy is derived from the more well-known Turtle Trading strategy. Richard Dennis and his partner William Eckhardt trained a group of novice traders, known as the “Turtles,” to follow a specific set of rules for trading futures. The Turtle Soup variant is designed to take advantage of potential reversals after a strong trend, particularly in forex and commodities markets.

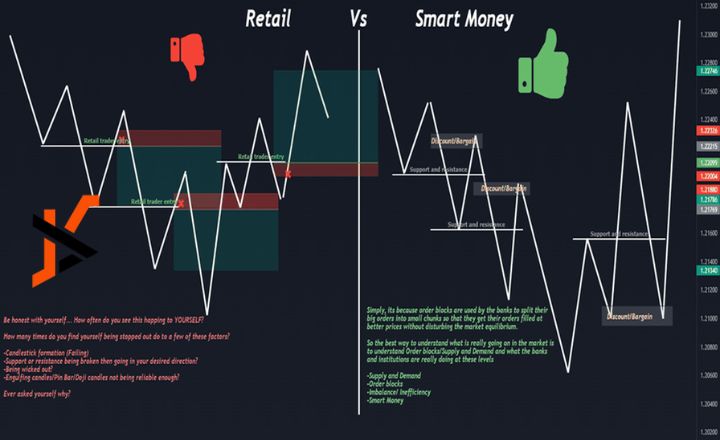

The strategy typically involves identifying a strong price movement (either upward or downward) and then looking for a reversal signal to enter a trade against that trend. The rationale behind this approach is that markets can be overextended, and traders can capitalize on the corrections that often follow significant price movements.

Mechanics of the Turtle Soup Trading Strategy

To effectively implement the turtle soup trading strategy success rate, traders must follow a series of steps:

- Identify Strong Price Movements: Traders need to monitor the markets for strong price movements. This can be defined as a significant increase or decrease in price over a specific timeframe.

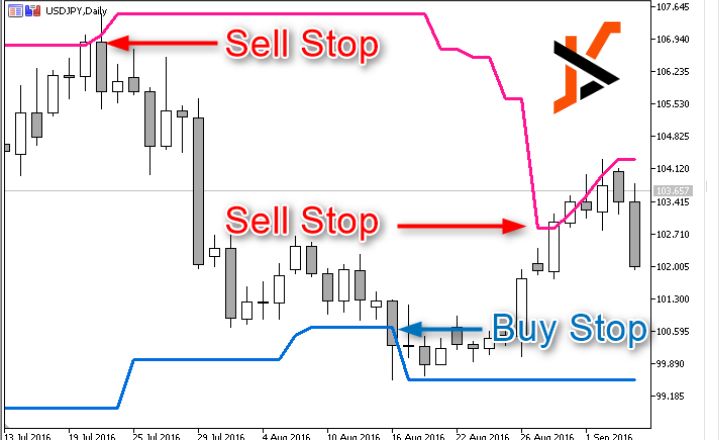

- Wait for a Reversal Signal: After identifying a strong trend, traders wait for a reversal signal. This can be determined using various technical indicators, such as moving averages, Fibonacci retracements, or candlestick patterns.

- Set Entry and Exit Points: Once a reversal signal is confirmed, traders set entry and exit points. This typically involves placing a stop-loss order to manage risk and a profit target to secure gains.

- Risk Management: Proper risk management is crucial in trading. Traders often use a percentage of their capital to determine position sizes and set stop-loss levels to minimize potential losses.

- Review and Adjust: As with any trading strategy, continuous evaluation and adjustment are essential. Traders must analyze their trades, assess their performance, and make necessary changes to improve their success rate.

Analyzing the Success Rate of the Turtle Soup Trading Strategy

The success rate of the turtle soup trading strategy success rate can vary based on several factors, including market conditions, the trader’s experience, and the specific rules used for entry and exit. While there is no definitive success rate applicable to all traders, a few key elements can influence the effectiveness of this strategy.

Historical Performance

The Turtle Soup trading strategy has shown promise in backtesting scenarios, particularly when applied to volatile markets like forex and commodities. Historical data often reveals that markets tend to revert after significant price movements, validating the strategy’s core premise. Traders who have diligently followed the rules and maintained strict risk management practices have reported varying degrees of success.

However, it is essential to note that past performance is not indicative of future results. Market conditions are constantly changing, and what worked in the past may not necessarily yield the same results in the future. As such, traders must remain adaptable and continuously refine their strategies.

Market Conditions

The success rate of the turtle soup trading strategy success rate is heavily influenced by market conditions. For example, during trending markets, the strategy may yield fewer successful trades, as prices may continue to move in one direction for an extended period. Conversely, in choppy or range-bound markets, the chances of experiencing reversals increase, potentially leading to higher success rates.

Traders should monitor market conditions and adjust their approach accordingly. Using technical indicators to gauge trend strength, volatility, and reversal signals can enhance the strategy’s overall effectiveness.

Trader Experience and Discipline

Another critical factor that impacts the success rate of the turtle soup trading strategy success rate is the trader’s experience and discipline. Successful trading requires a solid understanding of market dynamics, technical analysis, and risk management principles. Experienced traders are more likely to identify strong price movements accurately and recognize valid reversal signals.

Discipline is equally important. Traders must adhere strictly to their trading plan and avoid emotional decision-making. This means following entry and exit rules consistently and not deviating from the strategy based on market noise or fear of missing out.

Risk Management

Risk management is a cornerstone of any successful trading strategy, including the Turtle Soup approach. The success rate of this strategy can be significantly affected by how well a trader manages their risk. Setting appropriate stop-loss levels and position sizes helps protect capital and ensures that losses do not exceed acceptable levels.

Traders who incorporate effective risk management practices into their Turtle Soup trading strategy are likely to experience a more favorable success rate. A well-defined risk-reward ratio can also enhance overall profitability, even if the success rate is not exceptionally high.

Psychological Factors

Trading is not solely about technical analysis and strategy; psychological factors play a significant role in a trader’s success. Fear, greed, and overconfidence can lead to poor decision-making, ultimately affecting the success rate of the Turtle Soup trading strategy.

Traders must develop emotional resilience and maintain a disciplined mindset. This includes sticking to the trading plan, remaining patient during drawdowns, and avoiding impulsive trades based on emotions.

Conclusion

The turtle soup trading strategy success rate offers a unique approach to capitalizing on market reversals following strong price movements. While the success rate of the Turtle Soup trading strategy can vary based on several factors, including market conditions, trader experience, and risk management practices, it remains a valuable tool for traders looking to navigate the complexities of the financial markets.

Understanding the mechanics of the strategy and continuously evaluating its performance can help traders refine their approach and improve their chances of success. Ultimately, the Turtle Soup trading strategy can be a powerful addition to a trader’s toolkit, provided it is executed with discipline and a solid understanding of the underlying principles. Whether you are a novice trader or a seasoned professional, incorporating the Turtle Soup trading strategy into your trading plan can lead to rewarding opportunities in the ever-evolving landscape of financial markets.