There’s a reason financial desks pay attention to Dow Jones futures before the market even wakes up. They’re not just numbers flashing on a premarket screen; they reflect positioning, anticipation, and at times, anxiety. In a market shaped by anticipation as much as reaction, understanding futures becomes less about mechanics and more about reading sentiment in real time.

A contract that never sleeps: How Dow futures reveal market nerves

Futures tied to the Dow Jones Industrial Average offer exposure to the index outside traditional hours. Traders don’t wait for 9:30 AM to start making moves. The contracts begin trading Sunday evening and run nearly 24/5. That constant availability turns Dow futures into a kind of heartbeat for the market pulsing in response to global headlines, policy rumors, or tweets that stir investor nerves.

But unlike buying a company share, trading futures means entering a binding agreement to buy or sell at a set point. The price reflects where participants believe the index is headed, not where it’s been.

What Dow Jones futures signal before the opening bell

In the hours before the U.S. equity market opens, futures offer a preview. A green screen often means optimism. Red? It could be a weak earnings print from a major stock or concern over a rate hike. It’s not always predictive – sometimes the cash market does the opposite, but the gap between futures and reality tells its own story.

For long-only asset managers, futures serve a different purpose. They allow hedging without dumping stocks. If there’s concern over short-term downside, selling futures provides the cushion. It’s surgical, fast, and doesn’t disrupt long-term positions.

Speculation, with teeth

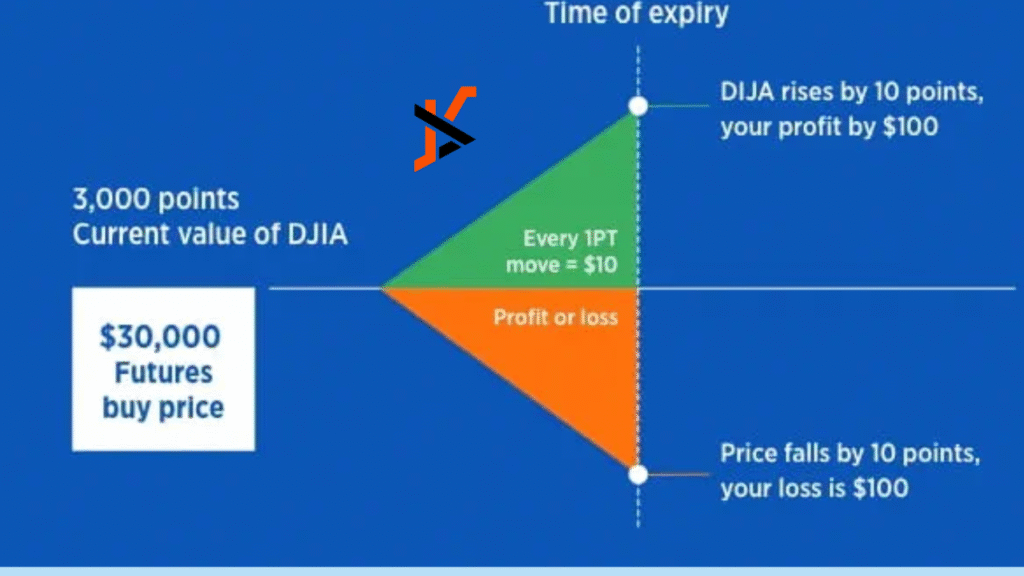

The leverage in these contracts is a double-edged tool. One slight movement in the index can mean a significant gain or loss. Unlike owning an ETF tracking the Dow, futures require constant attention. They’re more agile, but also less forgiving.

And then there’s volatility. Overnight sessions – especially in geopolitical tension – can move fast and break things. That volatility often finds expression first in futures, which react before the bell, before equity desks even process the headlines.

Dow index vs. futures: Why it’s a mistake to treat them the same

It’s easy to confuse the Dow Jones Industrial Average with the instrument built around it. The index is a benchmark — a historical relic, some say — made of 30 large-cap U.S. companies. However, Dow Jones futures are not the index; they reflect how the index might behave under pressure.

That distinction matters. You can’t trade the Dow directly. You can only express a long or short view through tools like futures. And when you do, you’re not just expressing an opinion. You’re putting capital behind it.

When Dow futures speak louder than headlines

The most underrated feature of Dow futures is their whispering when the market is silent. An early drop in Asian equities and a surprise central bank move in Europe ripple through futures contracts long before American investors finish their morning coffee.

They don’t always get it right. But they rarely ignore what’s coming. For seasoned investors, this early signal isn’t gospel; it’s context. And in markets, context is currency.