Market Overview

The global die casting mold market is poised for significant growth, with expectations of reaching impressive financial milestones. Strong trends and key drivers such as technological advancements and increased demand from various industries are steering the market forward.

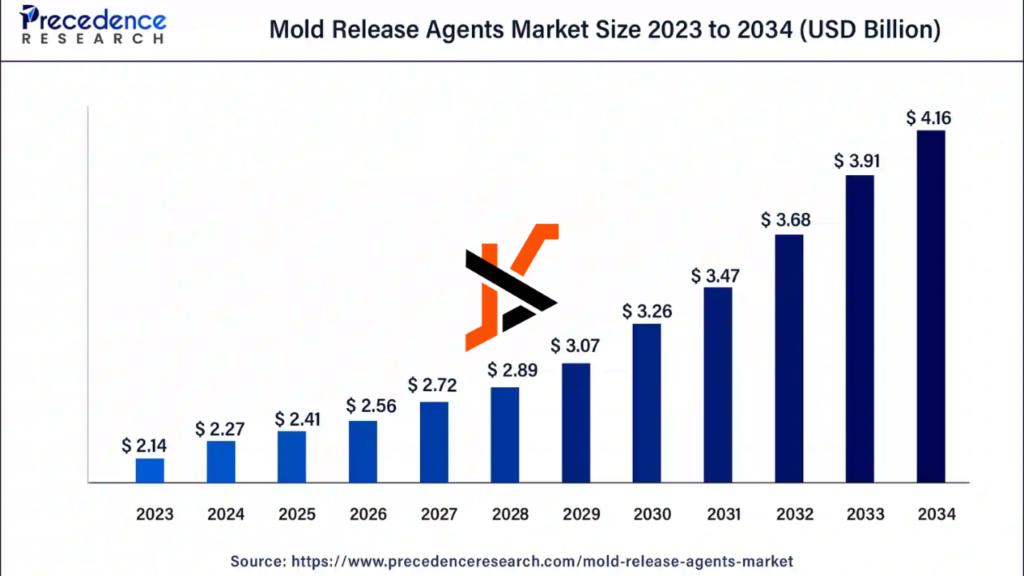

Current Market Size and Projections

The market has shown promising figures. In 2024, the market size was valued at about $77 billion. Looking ahead, experts estimate robust growth heading into 2025 with forecasts suggesting a rise to around $88 billion.

This projection signifies a healthy Compound Annual Growth Rate (CAGR) of about 6.24%. As an industry stakeholder or investor, these numbers highlight the opportunity for substantial returns within the die casting mold sector.

Growth Drivers and Market Trends

Growth in this market is fueled by several factors. One key driver is the rising demand in automotive applications. Die casting molds are essential for producing complex vehicle components efficiently. Technological innovations, like improved mold designs, are enhancing performance and cost-effectiveness.

Another trend is the expanding preference for lightweight materials such as aluminum, which complements the broader push for energy efficiency. This move toward lighter, stronger parts is especially prevalent in the automotive and aerospace industries.

Asia Pacific leads in market share due to its vast manufacturing base and demand for die-cast parts. As you look to navigate this market, these trends showcase areas worth your attention for informed decision-making and strategic planning.

Market Segmentation

In the global die casting mold market, segmentation helps understand the diverse factors at play. Key areas of focus include material types such as aluminum, zinc, and magnesium, and application in several industries. Geographic dynamics also provide insights into regional industry leaders and emerging markets.

By Material Type

Different materials offer varying benefits based on use. Aluminum is light and offers good strength, making it popular in many industries. Its use is common in sectors focusing on energy efficiency.

Zinc provides precise casting and is often chosen for its durability. It’s commonly found in consumer and industrial applications.

Magnesium stands out for being extremely lightweight and is valued in aerospace and automotive applications where weight is a crucial factor.

By Application Industry

In the automotive industry, die casting molds are crucial for producing lightweight but strong vehicle parts. With the shift to electric vehicles, the demand for aluminum and magnesium has been rising.

The consumer electronics sector uses die casting molds to achieve sleek designs with precise fitting parts, relying heavily on zinc for its ability to produce intricate designs.

Other industries also use die casting in small precision components, showing how these materials enhance product performance and manufacturing efficiency.

Geographical Segmentation

The market’s growth varies across regions. APAC, with countries like China and India, is a leader due to its vast manufacturing base and demand in the automotive and electronics sectors.

North America focuses on technological advancements and reduced production costs, driven by the automotive boom and a strong industrial base.

Europe emphasizes sustainability, leading to innovations in die casting processes and materials.

The Middle East and Africa are emerging markets, showing potential growth with increasing industrialization and investment in local manufacturing capabilities.

Each region showcases unique trends and demands, shaping the market collectively and regionally.

Technological Innovations in Die Casting

In the die casting industry, there have been significant advancements driven by the demand for more efficient and specialized processes. New technologies and materials are shaping the future of manufacturing, offering precision and customization like never before.

Advancements in Die Casting Processes

Die casting has transformed with improvements in processes that increase efficiency and quality. Modern methods utilize robotics to automate tasks, improving precision and reducing labor.

Robots help achieve consistent results, lowering defects and waste, which is vital in sustainable manufacturing. Customization has become easier, as digital tools allow manufacturers to tailor components more closely to specific needs. With these advancements, you can expect better product durability and performance.

Enhanced techniques have also led to faster production times and lower costs. This helps meet the rising demand in industries like automotive and electronics for high-quality die-cast parts.

Emerging Technologies and Materials

New technologies are incorporating lightweight materials such as aluminum and magnesium. These materials are crucial for producing vehicles with better fuel efficiency and lower emissions.

You will notice a shift towards sustainable practices as manufacturers aim to use eco-friendly materials and minimize energy consumption. Technology development now focuses on creating molds that can handle these lightweight materials without compromising strength.

Innovations in alloys enable the production of more durable and heat-resistant components. This serves sectors with high reliability requirements, such as aerospace and transportation. Adopting these materials supports sustainability goals while maintaining high-performance standards.

Competitive Landscape

The global die casting mold market features several key industry players and a diverse market share distribution. Knowing who dominates and how the market is split can give you an edge.

Key Industry Players

In the die casting mold market, a mix of global conglomerates and small to medium-sized enterprises actively shape the industry. Companies like S.S. Engineering Works, Rajshi, and Digi Tools stand out. Each contributes uniquely with their specialized products and innovative approaches.

You’ll also find names like Smiko Equipments and Eltec Engineering among important figures. These players invest in advancements and compete by offering tailored solutions and broadening their reach. Market leaders maintain their edge through research and expanding their supply chains.

Market Share Analysis

Market share in this industry is spread across both large and small participants. Global conglomerates hold significant portions, which grants them a competitive advantage. They often leverage their scale for efficiency and price benefits.

Medium and small enterprises fill niches by offering customized solutions and focusing on particular regional demands. This makes them competitive by serving specific customer needs very well.

You might notice a trend where companies pursue innovation to capture more share. Eltec Engineering and others invest heavily in new technologies, which can shift figures in upcoming years. Understanding these dynamics can help you anticipate future industry shifts.

Manufacturing and Supply Chain Analysis

Understanding how die casting molds are created and distributed is crucial. This involves looking at how molds are manufactured, what materials are used, and their costs. Also, the flow of supply and demand greatly impacts the market’s stability and growth.

Production Processes and Capacity

Die casting molds are created through a process that shapes metals like aluminum and magnesium into precise components. You’ll find that high-pressure techniques are common.

Capacity is determined by the number of machines and skilled labor in a factory. As demand for lightweight components, especially in the automotive sector, grows, manufacturers are expanding production capabilities to keep up.

Raw Material and Cost Analysis

Raw materials like aluminum and magnesium are essential for die casting molds. Their availability affects the cost and ultimately the pricing of molds.

Costs also include energy, labor, and transportation. Keeping these costs low ensures the cost-effectiveness of the manufacturing process. It’s important to keep an eye on fluctuations in the market prices for these materials, as they can lead to adjustments in production costs.

Supply-Demand Dynamics

To ensure success in the die casting mold market, understanding the supply-demand balance is key. Occasionally, there might be a gap between how much is made and how much is needed. Identifying these points early can help limit delays.

A strong supply chain system helps prevent these issues. You need to consider distribution networks that get the products to customers efficiently and reliably.

Economic Impact and Regulatory Compliance

The global die casting mold market is influenced by a number of factors, including strict environmental regulations and its effects on consumer goods and industrial sectors. Understanding these impacts can help you navigate the market’s challenges and opportunities more effectively.

Environmental Regulations and Sustainability

Regulations play a significant role in how companies make their die casting molds. You might notice that many countries are setting tough standards to lower environmental impact. These regulations push companies to use less energy and reduce waste.

Sustainable practices, like using recycled materials, are becoming more important. The energy consumption in traditional die casting can be high, so more eco-friendly methods are encouraged. Compliance with these rules can affect production costs but also lead to improved brand reputation and market position.

Impact on Consumer Goods and Industrial Sectors

Die casting molds are essential in various industries, including automotive and consumer electronics. For industrial sectors, ensuring compliance with regulations while maintaining efficiency can be a challenge.

You may find that consumer goods sectors demand high precision but also sustainability. Companies must balance these demands while adhering to energy regulations. Meeting these requirements can increase production costs but often results in higher-quality products, which can be more appealing to eco-conscious consumers.