Introduction

If you use your car for work, charity, or medical reasons, you may be entitled to valuable tax deductions through the IRS mileage rate. This guide will help you understand how the system works, who qualifies, and how to stay compliant with IRS standards.

The mileage rate is one of the most straightforward ways to lower your taxable income without complicated accounting or piles of receipts. But to take full advantage, you need to know how to apply the rate properly—and how to maintain proper records throughout the year.

What Is the IRS Mileage Rate?

The IRS mileage rate is a standard figure the government sets each year to represent the average cost of operating a vehicle. It allows taxpayers to deduct a fixed amount per mile driven for qualified purposes. Instead of tracking gas, repairs, and depreciation separately, you multiply your total qualifying miles by the IRS-set rate.

This rate is updated annually to reflect changing fuel prices, maintenance costs, insurance premiums, and other economic conditions. It provides a simpler and more consistent way for taxpayers to claim deductions compared to the actual expense method, which involves documenting every cost associated with vehicle ownership.

Who Can Use the Mileage Rate?

The IRS mileage rate applies to a range of taxpayers, but it’s most commonly used by self-employed individuals, freelancers, and small business owners who use their personal vehicle for work.

Here are the primary categories of use:

- Business Use: If you’re self-employed or own a business and use your personal vehicle to meet clients, attend events, or make deliveries, you can claim business mileage.

- Medical Use: Travel for medical appointments or procedures may be deductible if it meets the IRS’s threshold for medical expenses.

- Charitable Use: If you volunteer for a nonprofit and use your car to drive to events or service activities, you may qualify for a deduction.

- Moving (Military): Since 2018, only active-duty military members moving under orders can deduct moving-related mileage.

Employees typically cannot deduct mileage unless they fall into very specific categories due to recent changes in tax law. If you’re a W-2 employee, you should instead seek reimbursement through your employer.

IRS Mileage Rate vs. Actual Expense Method

When claiming vehicle-related deductions, you have two options: the IRS standard mileage rate or the actual expense method.

The mileage rate is easier and cleaner. It only requires that you track your qualifying miles and maintain a detailed log. The actual expense method can be more complex, involving fuel receipts, maintenance bills, insurance records, and a prorated portion of car expenses.

While the actual expense method can yield a higher deduction for some, especially those with high operating costs, the mileage rate is usually more practical for most taxpayers. It’s also more audit-friendly if your records are organized.

How to Track Miles for IRS Deductions

To use the IRS mileage rate, the IRS requires detailed records. These records must be maintained regularly and must include specific information about each trip. The IRS does not accept estimates or round numbers.

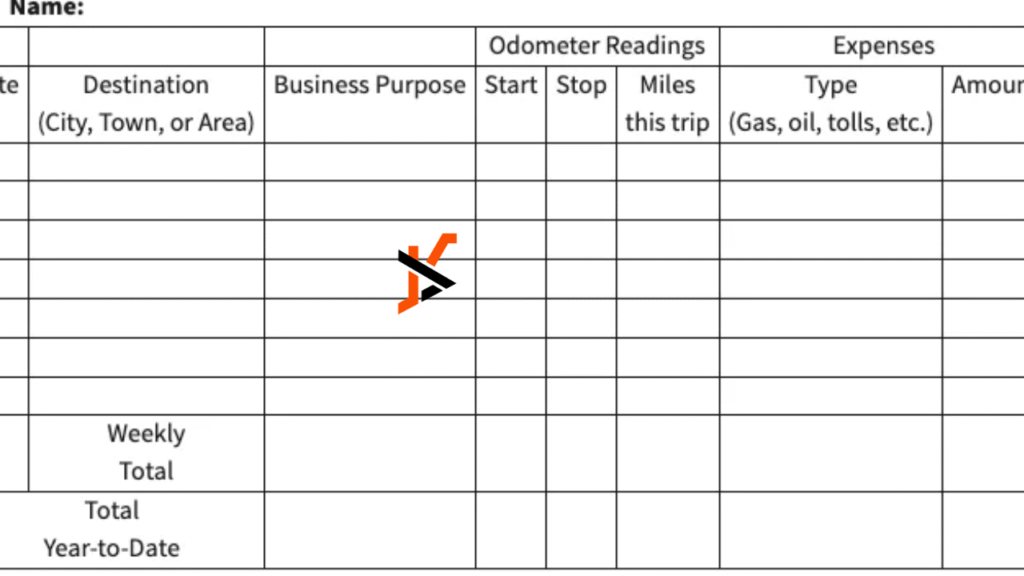

Here’s what your mileage log should include:

- Date of the trip

- Starting location and destination

- Purpose of the trip

- Total miles driven

You can track this information manually using a notebook or spreadsheet, but many people prefer to use mileage-tracking apps that automate the process. Tools like Everlance, MileIQ, and TripLog are designed specifically to help you log trips, categorize them, and generate IRS-compliant reports.

Keeping consistent logs is key—waiting until the end of the year to recreate your driving history is risky and often inaccurate. The IRS expects “contemporaneous” records, meaning logs made close to the time the trip occurred.

How the Mileage Deduction Works in Real Life

Let’s walk through a real-world example.

Suppose you’re a freelance consultant who regularly meets with clients across your city. In 2025, you drive a total of 7,200 miles for work. If the IRS business mileage rate is 65.5 cents per mile, your deduction would be calculated as follows:

7,200 miles × $0.655 = $4,716

That $4,716 can be subtracted from your gross income when you file your taxes, lowering your taxable income and potentially your tax bracket. For someone in the 24% tax bracket, that deduction would reduce your tax liability by more than $1,100.

Limitations and Restrictions

While the mileage rate is widely used, there are some important restrictions to understand:

- No commuting deductions: Driving from your home to your regular place of work is considered commuting and is not deductible.

- Fleet vehicles: If you operate five or more vehicles simultaneously (like a delivery fleet), you cannot use the mileage rate method.

- Depreciation limitations: Once you switch to the actual expense method for a vehicle and claim depreciation, you generally can’t go back to the mileage rate for that same vehicle.

- Leased vehicles: If you’re leasing a car, you must use the same method (mileage or actual) for the entire lease period.

Understanding these limitations ahead of time helps prevent errors that could cost you during an IRS review.

Tips for Maximizing Your Mileage Deduction

Here are a few best practices for making the most of the IRS mileage rate:

- Start tracking on January 1: Begin logging your trips at the very start of the year to avoid gaps or missed miles.

- Separate business and personal trips: Only business-related driving counts. Be sure to categorize each trip accurately.

- Use reliable tracking tools: Digital logs are easier to maintain and export, especially if you’re audited or need to work with a tax professional.

- Check the official rate: Confirm the correct mileage rate for the year before calculating your deduction. Rates can vary between business, medical, and charitable uses.

A consistent, accurate log not only maximizes your deduction but also protects you in case of an audit.

Planning Ahead with the IRS Mileage Rate

Beyond just tax savings, the mileage rate can help you manage and forecast your business expenses. If you’re a contractor or business owner, you can estimate how much your driving will cost—and how much of that can be deducted at the end of the year.

For example, if you expect to drive 10,000 business miles in 2025, and the IRS mileage rate remains close to 65.5 cents per mile, you can plan for around $6,550 in deductions. This knowledge can help you set pricing, calculate budgets, or make decisions about leasing versus buying a vehicle.

Conclusion

The IRS mileage rate remains one of the simplest and most powerful tools for reducing taxable income if you use your car for work, charity, or qualified personal reasons. But like any IRS deduction, it comes with clear rules and documentation standards.

To stay compliant and maximize your deduction, track your miles carefully, use the correct rate, and keep your logs up to date. Whether you’re a full-time freelancer or someone who occasionally drives for volunteer work, applying the mileage rate correctly can lead to meaningful savings at tax time.