In the fast-paced world of software, flashy growth often gets more attention than solid numbers. Startups celebrate revenue milestones, investor rounds, and user counts. But beneath all that noise, one quiet but powerful tool separates the products that scale from those that stall: unit economics. It’s not a buzzword, it’s a backbone.

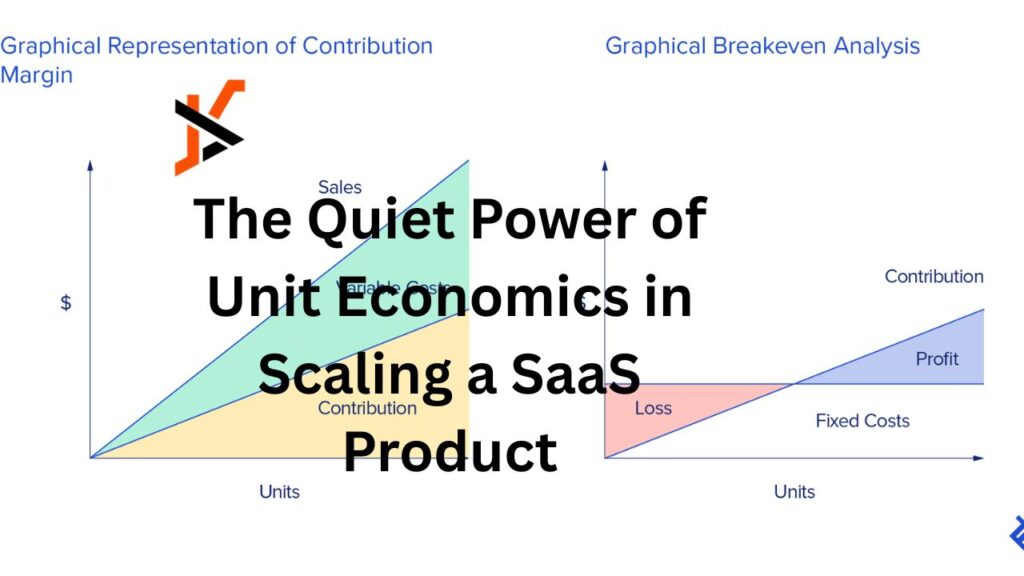

At its core, unit economics means understanding how much money you make or lose on every customer. You look at what it costs to get a customer, what you earn from them, and how long they stay. It’s simple math, but in SaaS, it shapes how you grow. If your cost to get a user is more than what you make from them, no amount of growth can save you.

Startups that master unit economics early build stronger products and smarter growth strategies. They can raise less, spend better, and scale with confidence. Whether it’s a small bootstrapped tool or a venture-backed platform, SaaS businesses that focus on these numbers early avoid the trap of scaling a money-losing model.

Why Unit Economics is the Real MVP of SaaS Growth

Many SaaS companies chase growth before they fully understand their core metrics. They build big teams, launch major campaigns, and even expand internationally—all while losing money on each new user. That’s dangerous. It can hide real problems until it’s too late.

A better way is to deeply understand Customer Acquisition Cost (CAC), Lifetime Value (LTV), churn, and gross margins. When your LTV is 3x or more of your CAC, you’re on the right path. When churn is low and margins are healthy, you have room to invest in growth.

Companies like Slack, Zoom, and Canva didn’t just grow fast—they scaled with strong unit economics. Their early focus on sticky products, low churn, and efficient customer acquisition helped them survive and thrive.

Sreekrishnaa Srikanthan, Head of Growth at Finofo, shares:

“At Finofo, we focus on the fundamentals. I learned early on that strong unit economics isn’t just helpful—it’s essential for sustainable scaling. We ran multiple experiments in our first year, tracking CAC against LTV ratios and doubling down where we saw a 5x return. That discipline helped us avoid costly expansion mistakes and instead, build deeper roots in key markets.”

Sreekrishnaa’s approach highlights a mindset shift: real growth comes from what you keep, not just what you capture.

Product-Led Growth and the Power of Focus

SaaS companies that grow well often follow a product-led growth (PLG) model. That means users find value in the product before they ever talk to sales. PLG is a great match for strong unit economics because it drives down CAC and increases user lifetime.

But to make PLG work, teams need to track everything. How users interact, where they drop off, when they convert. That data becomes the roadmap. When done right, you get users who pay more, stay longer, and cost less to acquire.

Padito Linkero, founder of Padibet, a niche online product company, sees unit economics as the ultimate test:

“We were excited to grow fast, but it wasn’t until we truly focused on unit economics that we saw real progress. I remember digging into our numbers and realizing our most expensive campaign brought in our least valuable users. That led us to pause ad spend and rework onboarding. Our margins jumped 22 percent in two months—and we didn’t even add new features.”

His story is a powerful reminder that scaling is about clarity, not just activity.

Beyond Metrics: Mindset, Modeling, and Margins

To scale with purpose, SaaS founders need more than dashboards—they need a mindset. That means caring about profit even when investors care about growth. It means modeling every marketing move, every hiring plan, and every feature roadmap against unit-level returns.

A $99/month customer may sound great, but not if it takes $400 to close and they churn in three months. Understanding these relationships keeps your growth honest.

Daniel Hebert, founder of yourLumira by SalesMVP Lab Inc, speaks from experience:

“As a founder and sales coach, I’ve seen too many teams chase vanity metrics. At yourLumira, we’ve been careful to design not just the product but the entire customer journey around high-value, low-churn behavior. One change we made—adding a therapist onboarding guide—cut cancellations by 38 percent. That single improvement reshaped our LTV model and gave us the clarity to scale without second-guessing.”

Daniel’s experience shows how even small changes, when backed by data, can unlock huge returns.

Conclusion: Quiet Math, Loud Impact

Unit economics might not grab headlines, but it builds businesses that last. It tells you whether you’re building a real company or just buying growth. And it helps founders focus on what really matters: sustainable, smart scaling.

The stories from Finofo, Padibet, and yourLumira all show the same truth—when you know your numbers, you make better choices. You avoid waste, find real product-market fit, and grow with peace of mind.

So before the next big hire, launch, or funding round, ask the question that matters most:

Are we making money every time we gain a user?

If the answer is yes, scale away. If not, dig into the quiet power of your unit economics—because that’s where real success begins.