If you’ve ever heard of Seasons Federal Credit Union and wondered what it is, you’re in the right place. This article will explain everything in a way that’s easy to understand—even for a 10-year-old. From savings accounts to student services, this guide will walk you through what Seasons Federal Credit Union is, what it offers, and why so many people choose it over a regular bank. Plus, we’ll cover online banking, car loans, and even whether your money is safe. Let’s get started!

What Is Seasons Federal Credit Union?

Seasons Federal Credit Union, often called SFCU, is a credit union based in the United States. That means it’s a financial institution like a bank—but with some important differences. Instead of being owned by investors who want to make a profit, credit unions are owned by their members. So when you open an account at Seasons Federal Credit Union, you’re not just a customer—you’re a part-owner.

This makes Seasons Federal Credit Union a community-focused and member-driven organization. It was created to help people, not to make money for shareholders. You can save money, get loans, and manage your finances here just like at a bank, but the profits are shared back with members through better rates and lower fees.

Many people love that Seasons Federal Credit Union is local and friendly. It was designed to serve people in Connecticut, but with online access, it helps many others as well. If you care about good customer service and better financial benefits, Seasons might be the right choice for you.

Why Do People Like Seasons Federal Credit Union?

People like Seasons Federal Credit Union for many reasons. One of the biggest is that it’s not-for-profit, which means more of the money goes back to the members. You’re not just giving your money to a big company—you’re keeping it in your community.

Also, members often enjoy lower fees, better interest rates, and more personal service than they would get from a traditional bank. For example, you might earn more interest on your savings account or pay less in fees when you take out a loan.

Seasons Federal Credit Union also offers tools and resources to help people learn about money. Whether you’re just starting to save or trying to manage credit card debt, Seasons provides guidance without judgment. Many people say it feels more like a partnership than a business.

What Can You Do With a Seasons Federal Credit Union Account?

When you open an account at Seasons Federal Credit Union, you’re opening the door to many financial services. These aren’t just any services—they’re designed to make your life easier and your money go further.

Easy Savings Accounts

At Seasons, you can start with a basic savings account that earns interest. That means the money you put in will grow slowly over time. You don’t need a lot of money to start, and there are no huge fees.

These savings accounts are perfect for building an emergency fund, saving for a trip, or teaching your kids how to handle money. With low minimum balances and competitive interest rates, it’s an easy first step to financial freedom.

Helpful Checking Accounts

Need to pay bills, go shopping, or get your paycheck direct-deposited? A checking account from Seasons Federal Credit Union can do all that. These accounts often come with no monthly fees, free debit cards, and even rewards for certain purchases.

There are even options for overdraft protection so you won’t get slammed with a bunch of surprise charges. Many people love how easy it is to track their spending with Seasons’ mobile app.

Fast Personal Loans

Sometimes you need extra cash for big expenses—like fixing your car or paying off high-interest credit cards. That’s where Seasons Federal Credit Union’s personal loans come in. You can borrow money at lower interest rates than most credit cards or payday loans, and pay it back in affordable monthly payments.

These loans are processed quickly, and you can even apply online. Whether you need a little or a lot, it’s a flexible way to handle life’s unexpected costs.

How to Join Seasons Federal Credit Union

Joining Seasons Federal Credit Union is easier than you might think. You don’t need to be a financial expert or rich to become a member. In fact, all you need to do is meet one of their membership criteria. These usually include living, working, studying, or worshipping in certain areas of Connecticut.

You can apply online or visit a branch to get started. All it takes is a small opening deposit—usually around $5. Once you’re in, you’ll have access to all their great services, plus the right to vote in credit union decisions. It’s like joining a club that helps you save money and grow your financial future.

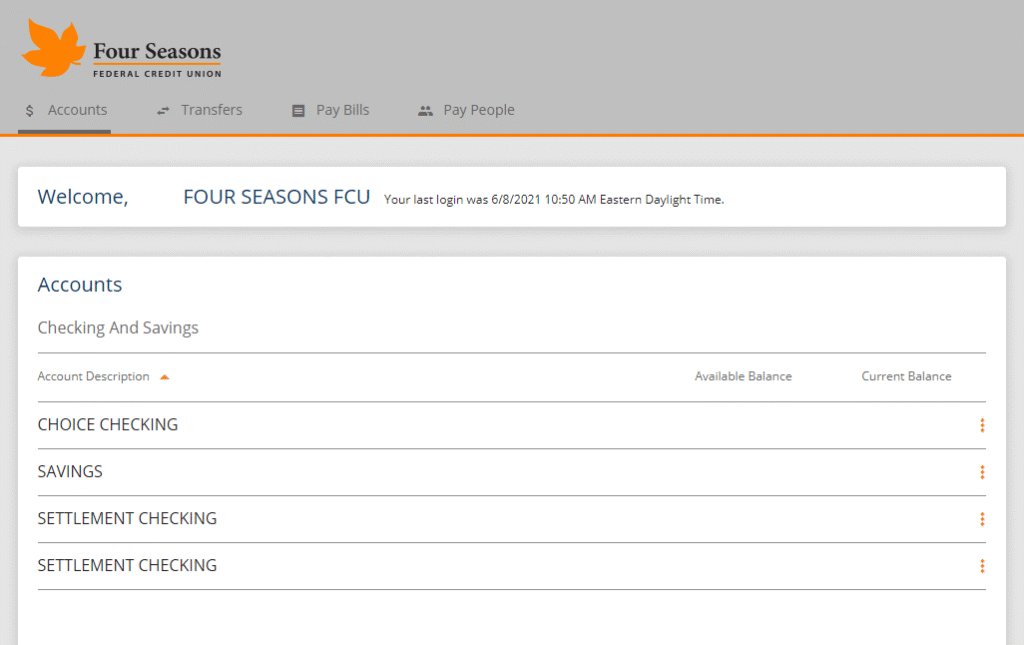

Does Seasons Federal Credit Union Offer Online Banking?

Yes, and it’s really good! Seasons Federal Credit Union offers a full online banking experience that lets you manage your money from your computer or smartphone. You can:

- Check your balance

- Transfer money between accounts

- Pay bills

- Deposit checks using your phone camera

- Set up alerts to track your spending

This means you don’t need to visit a branch to take care of your finances. Whether you’re traveling or just busy, Seasons’ mobile banking app keeps you connected. It’s fast, safe, and easy to use.

Do They Have Special Accounts for Students or Teens?

Absolutely. Seasons Federal Credit Union understands that young people need help learning about money. That’s why they offer special accounts just for kids, teens, and college students.

Youth Savings Accounts

The youth savings account is a great way to teach kids about saving money. Parents can open an account for their children, and even set up automatic transfers to build up savings over time. There are no big fees, and kids get to watch their money grow.

Teen Checking Accounts

For teens who are starting to earn money from chores or part-time jobs, Seasons offers teen checking accounts. These come with a debit card and online access, so teens can learn how to manage their spending.

Parents can monitor the account and set limits, making it a smart and safe way to give teens financial freedom while teaching them responsibility.

Can I Get a Car Loan or Home Loan Here?

Yes! Seasons Federal Credit Union offers both auto loans and home loans. If you’re ready to buy your first car or dream home, they can help make it happen.

- Auto Loans: With low rates and flexible terms, you can buy a new or used car without stressing over high payments. They even offer pre-approval, so you’ll know your budget before you go car shopping.

- Home Loans: Whether you’re buying your first home or refinancing, Seasons has mortgage options that can save you money. They offer fixed-rate and adjustable-rate loans, as well as help with closing costs.

Their team will guide you every step of the way and make sure you understand what you’re signing up for.

Is My Money Safe at Seasons Federal Credit Union?

Yes, your money is very safe at Seasons Federal Credit Union. Just like banks, credit unions are insured. Seasons is backed by the National Credit Union Administration (NCUA), which means your money is protected up to $250,000 per account holder.

So even if something unexpected happened, your funds would still be secure. That’s peace of mind you can count on.

The Bottom Line

Seasons Federal Credit Union isn’t just another financial institution—it’s a community-focused, member-first credit union that wants to help people succeed. Whether you’re saving for the future, buying your first car, or teaching your kids how to handle money, Seasons has tools and services designed to make your life easier.

It offers everything from simple savings accounts to full-service online banking, and it does it all while keeping your best interests in mind. With low fees, great rates, and a focus on people—not profit—it’s easy to see why so many people love banking with Seasons.